Sometimes while doing statistical analysis you are required to calculate Net present value.Manual computations of Net present value are difficult and time-consuming.Amidst this challenge, the question arises: How can we tackle this hurdle? Fear not, for within these lines lie the answers you seek. Discover the solutions that await as you delve into this enlightening article.

What is Net Present Value ( NPV )

The Net Present Value (NPV) of an investment or project is a financial indicator used to determine its profitability. It is the difference between the present value of cash inflows and the present value of cash outflows for a certain time period.

How to Use NPV Formula in Excel

Using the NPV (Net Present Value) formula in Excel is a powerful tool for evaluating investment opportunities. It allows you to compute the present value of future cash flows while accounting for the time value of money.

In this articles, we will explore three different methods to perform NPV calculations in Excel:

Method 1: Using Insert function button in excel to perform Excel Net present Value Calculation:

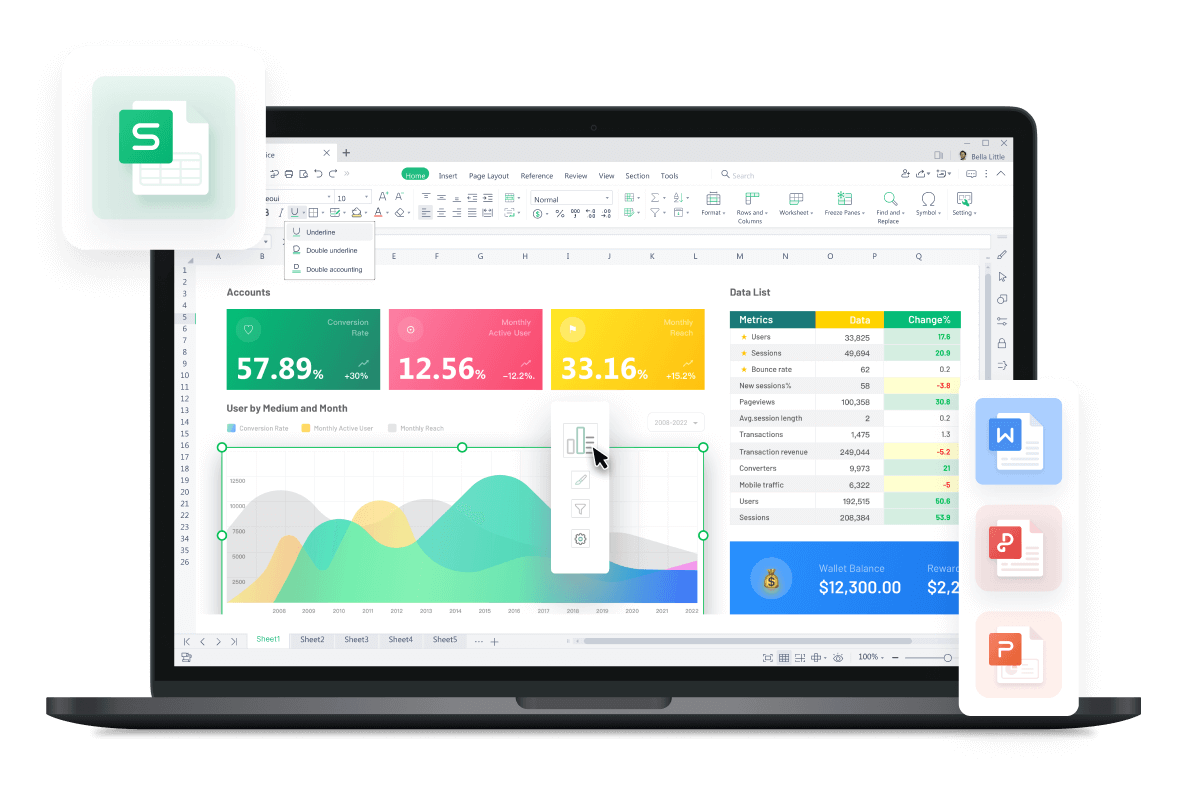

Step 1. Launch the WPS Excel/Spreadsheet file.

Step 2. Click on the cell where you want Excel Net Present Value Calculation to be performed.

Step 3. Select the Formulas tab.It will include an Insert formula button. Press this button.

Step 4. Click NPV and then OK.

Step 5. Press enter after inputting all two parameters.

Method 2: Using Financial formula section in excel to perform Excel Net present Value Calculation

Step 1. Launch the WPS Spreadsheet file.

Step 2. Click on the cell where you want Excel Net Present Value Calculation to be performed.

Step 3. Select the Formulas tab.

Step 4. A drop down menu will display.Find and choose NPV from the list.

Step 5. A new function argument window will be shown. You may either input the values for these two parameters or utilize the excel value links shown in the images in this text.

Step 6. Press enter after inputting all two parameters.The net present value is computed.

Method 3: Manually entering Net present value Formula in excel to perform Excel Net present Value Calculation

Step 1. Open your file in WPS Spreadsheet

Step 2. Click on the cell where you want Excel Net Present Value Calculation to be performed.Enter "=NPV" and then press Tab.

Step 3. The net present value formula is started.Two separate parameters are necessary to compute net present value.

Step 4. Press enter after inputting all two parameters.

Benefit of using NPV

There are several benefits to using NPV (Net Present Value) in financial analysis:

Decision-making tool: NPV helps in making informed investment decisions by considering the time value of money. It provides a clear assessment of the net value or profitability of an investment, allowing you to compare different investment options and choose the most financially viable one.

Incorporates cash flow timing: NPV takes into account the specific timing of cash flows, allowing for a more accurate evaluation of investment returns. It recognizes that cash received earlier is more valuable than cash received in the future, as it can be reinvested or earn interest.

Considers the cost of capital: NPV considers the discount rate, which represents the cost of capital or the required rate of return. By factoring in the cost of capital, NPV accounts for the risk and opportunity cost associated with an investment, providing a comprehensive assessment of its value.

Provides a comprehensive financial picture: NPV considers all relevant cash inflows and outflows over the investment's lifespan. It takes into account initial investments, ongoing cash flows, and terminal values, providing a holistic view of the investment's financial implications.

Facilitates comparison of projects: NPV enables the comparison of different projects or investment opportunities. By calculating and comparing their respective NPVs, you can identify the most financially attractive option and allocate resources accordingly.

Overall, NPV is a valuable tool for financial analysis as it accounts for the time value of money, incorporates cash flow timing, considers the cost of capital, and facilitates effective decision-making and project comparisons.

FAQs

1. What is the difference between NPV and XNPV?

NPV calculates present value based on a fixed discount rate, while XNPV handles irregular cash flows by considering specific dates for each cash flow. XNPV is more suitable for non-uniform cash flow scenarios as it accurately accounts for the time value of money.

2. Why is NPV not accurate?

Because NPV calculations need the selection of a discount rate, they might be erroneous if the incorrect rate is used.Adding to the complexity is the chance that the investment may not have the same amount of risk across its whole time horizon.

3. How do I manually calculate NPV in Excel?

Excel includes an NPV function using the following syntax:

NPV = (rate, [value1], [value2],...)

The following arguments are required by the aforementioned formula:

rate - the discount rate for a single time period.

Summary

In conclusion, as you explored the three recommended methods of calculating NPV in Excel - utilizing the Insert function button, leveraging the Financial formula section, and manually entering the NPV formula - you gained valuable insights into streamlining your calculations.

It is worth mentioning the benefits of using WPS Office's Spreadsheet tool, which seamlessly integrates with Excel, providing you with a user-friendly platform to perform NPV calculations effortlessly. By leveraging the power of WPS Office, you can confidently navigate the intricacies of NPV analysis, enhancing your financial decision-making process and making informed investment choices.