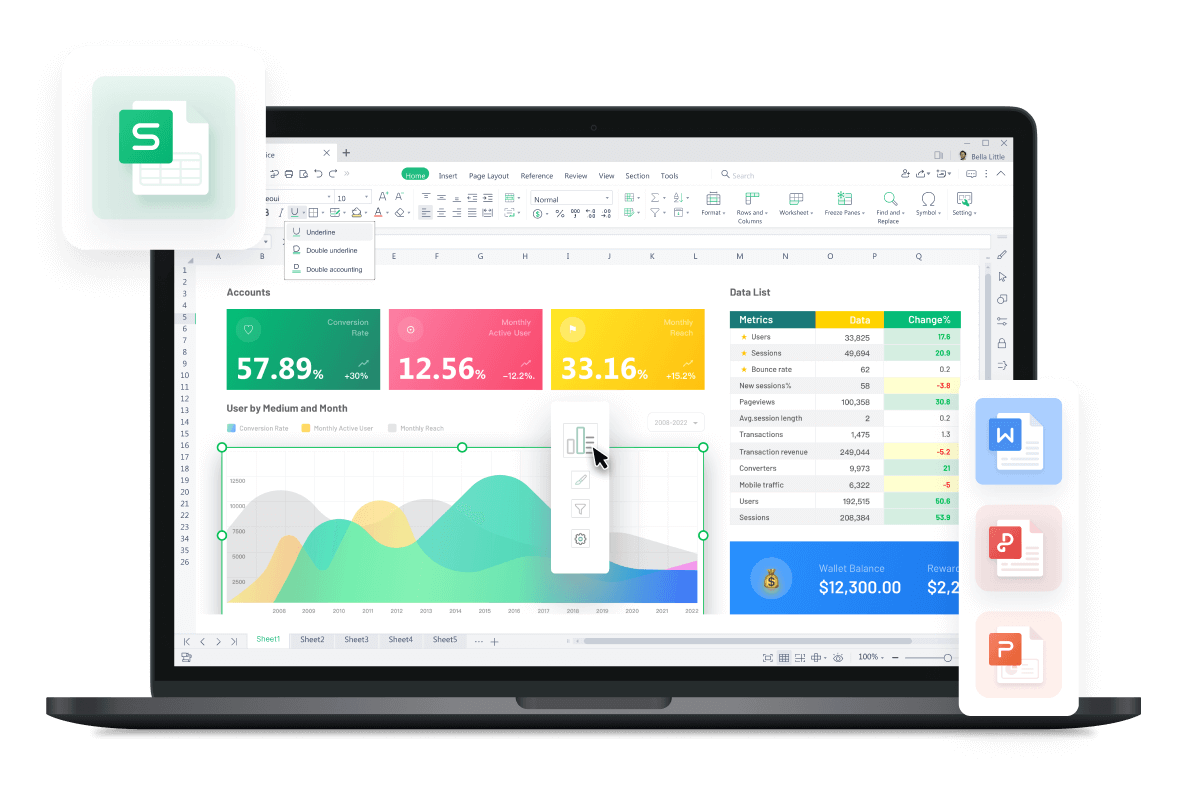

Free All-in-One Office Suite with PDF Editor

Edit Word, Excel, and PPT for FREE.

Read, edit, and convert PDFs with the powerful PDF toolkit.

Microsoft-like interface, easy to use.

Windows • MacOS • Linux • iOS • Android

Catalog

The best 10 free excel amortization templates

Excel is doing a great job by providing exceptional and fantastic templates. There isn't a single task that Excel templates can't help you with; they are all incredibly helpful. Even a fixed-rate loan is scheduled out into equal installments through the amortization process. Each installment includes interest payments in part and loan principal payments in part.

An excels loan amortization calculator or table template is the simplest approach to determine payments on an amortized loan. These are the best 10 free excel amortization templates easily available to use now. The list has photos and links as well.

1. Loan Amortization Schedule Template

For level-payment loans, a loan amortization schedule template is a table that lists each periodic loan payment that is due, which is normally due each month.

2. Useful Loan Amortization Schedule Template

A useful loan amortization schedule template is a table that lists each monthly periodic loan payment that is due for level-payment loans. This spreadsheet is now easy to use. Free to download as well.

3. Useful Loan Calculator Template

This amortization calculator template displays a schedule, graph, and pie chart breakdown of amortized debt and monthly payment amounts. It is free to use now.

4. Loan Payment Calculator Template

If you are the one who is looking to use fixed payment, a free payment calculator to determine the monthly payment amount or the length of time needed to pay off a loan, then this amortization template is best for you. Free download it now.

5. Modern Fresh Contract Invoice Template

The Modern Fresh Contract Invoice template is now available for download from the WPS office in EXCEL.

6. Mortgage Payoff Calculator Template

Using a free excel mortgage payoff calculator template, you may assess your alternatives for paying off your mortgage faster, like making extra payments, paying it off completely, or biweekly.

7. Debt Reduction Calculator Template

Free excel amortization calculator templates are for calculating the most efficient way to pay off several debts, including mortgage, auto, and credit card obligations.

8. Business Loan Agreement Template

Free download this excel amortization template for free of cost.

9. Useful Purchase Order Invoice Template

After the buyer has given the seller a purchase order and the order has been accepted and fulfilled, a purchase invoice is produced. It includes the same details as a standard invoice and the buyer's commitment to pay the seller by the due date. For this purpose, the amortization template for Excel is available for free download.

10. Simple Useful Sales Invoice Template

This easy amortization invoice template for Excel displays client information, shipping and billing addresses, a description, and an amount. It computes subtotal, tax rate, and sales automatically.

Customize Your Amortization Schedule Excel Template

Step 1 Open the Amortization Schedule Excel Template in WPS Office.

Step 2 Review the template's structure and predefined formulas then modify the loan details, such as loan amount, interest rate, and term, in the designated cells.

Note: Update any additional parameters, such as payment frequency or extra payments, if needed.

Step 3 Customize the formatting, fonts, colors, or layout to match your preferences or branding. Verify that the formula references remain intact and adjust them if you've made any changes.

Step 4 Choose Save As from the drop down Menu then choose file format

Step 5 Locate your file then click Save As

Save your customized template with a new name to avoid overwriting the original template.

Pros

Time-saving: By downloading a pre-made template, you save time and effort in creating the structure and formulas from scratch.

Cost-free: As these templates are available for free, you don't need to spend any money to access them.

Customizable: Templates can be easily tailored to fit your specific amortization schedule needs, allowing you to input your loan details and customize formatting as desired.

Professional look: The templates are designed to be visually appealing and organized, providing a polished and consistent appearance.

Learning opportunity: By working with a template, you can gain insights into the structure and formulas used in creating amortization schedules, enhancing your understanding of the process.

Take a Closer Look at Excel Amortization Schedule

What is an Excel amortization schedule?

An Excel amortization schedule is a table that shows the repayment plan for a loan or mortgage. It breaks down each payment into principal and interest components and tracks the remaining balance over time.

Why Should You Use Excel Amortization Schedule

Clear payment breakdowns: An amortization schedule shows how much of each payment goes towards principal and interest, providing transparency.

Effective budget planning: An amortization schedule helps you plan and manage your loan payments by providing a clear view of the total repayment amount and payment timing.

Loan option comparison: You can compare different loan options by creating amortization schedules, simplifying the decision-making process.

Analysis of interest costs: An amortization schedule allows you to see the total interest you'll pay, helping you assess the impact of interest on your repayment.

Assessment of early payoff strategies: With an amortization schedule, you can analyze the effects of making extra payments or paying off the loan early, simplifying the evaluation process.

Record-keeping tool: An Excel amortization schedule acts as a convenient record of your loan payments, helping you track your payment history and monitor progress.

FAQs about Amortization Schedule in Excel

How to choose the best way to make an amortization schedule in excel?

If you have enough time and prefer customization, create your own schedule in Excel. Otherwise, use an Excel template for a quick solution. For rough requirements, templates or SmartArt can suffice. For professional needs, choose a customizable template or create step by step.

What is an example of amortization?

Equipment Amortization:

Equipment Cost: $50,000 Equipment Useful Life: 10 years Yearly Amortization Expense: $5,000 ($50,000 / 10 years)

In this example, if you have acquired equipment for $50,000 with an estimated useful life of 10 years, you would record an annual amortization expense of $5,000. This reflects the gradual reduction of the equipment's value over its useful life.

How is an amortization schedule calculated?

Let's consider a car loan of $20,000 with an interest rate of 4.5% for a term of 5 years, resulting in monthly payments. We'll calculate the loan amortization schedule based on the known monthly payment of $370.

Start with the initial loan balance: $20,000

Calculate the monthly interest: Multiply the outstanding loan balance by the monthly interest rate. For the first month, the monthly interest rate is (4.5% / 12) = 0.375%. So, the interest for the first month is $20,000 * 0.00375 = $75.

Subtract the interest from the monthly payment to determine the principal payment: $370 - $75 = $295.

Subtract the principal payment from the initial loan balance to get the new loan balance: $20,000 - $295 = $19,705.

Repeat the process for subsequent months, using the new loan balance:

For the second month:

Monthly interest: $19,705 * 0.00375 = $74.14

Principal payment: $370 - $74.14 = $295.86

New loan balance: $19,705 - $295.86 = $19,409.14

Continue these calculations until the loan balance reaches zero.

Can I Automate the Amortization Schedule in Excel?

Yes, you can automate the amortization schedule in Excel by using the built-in Loan Amortization Schedule template or by creating your own table with formulas.

Conclusion

In this comprehensive guide, we explored two ways to create an amortization schedule in Excel. The first method involved downloading a free Amortization Schedule Excel Template and customizing it to fit your loan details and preferences. This approach saves time and effort as the template provides a pre-designed structure with formulas.

By using these methods and leveraging the resources provided by WPS Office, you can simplify loan payment calculations and gain valuable insights into your financial journey.

Also Read:

- 1. Best 10 excel dashboard examples in free excel 2022

- 2. 10 quick loan amortization schedule excel templates

- 3. The best 10 free excel amortization templates

- 4. Top 10 Excel Template for Loan Amortization

- 5. The most fabulous 10 free Excel amortization templates for 2022

- 6. The best 10 excel event planning templates for free